Soon Hock is a specialized developer of industrial properties operating in Singapore, with a successful track record of developing assets valued at over S$1.0 billion.

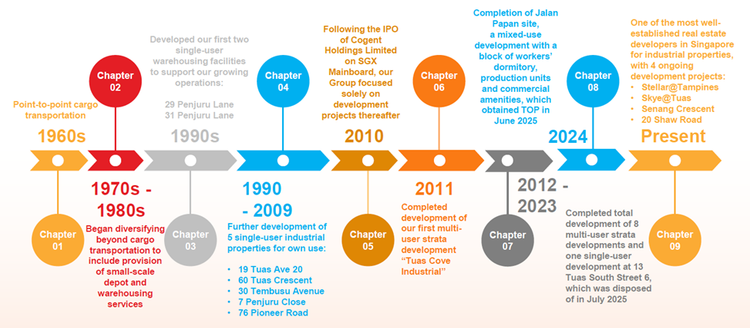

The company’s journey in property development began in the 1980s when it opted to create its own warehousing facilities to meet operational requirements. The initial projects were completed at 29 and 31 Penjuru Lane, with their completion dates in 1991 and 1993, respectively.

Under the leadership of Tan Yeow Khoon, who has more than 50 years of experience in logistics and transportation management services, Soon Hock has established itself as a significant player in the industrial property sector.

On October 16, 2025, Soon Hock was listed on the Singapore Stock Exchange. The founder’s family remains the largest shareholder, holding a stake of 70.2%.

The group operates exclusively within Singapore, adhering to policies and industrial zoning regulations set by Jurong Town Corporation (JTC). This regulatory framework creates substantial barriers for new entrants while curbing speculative land banking practices.

Industrial Developments in Strategic Locations

Soon Hock strategically situates its properties within established industrial estates such as Kaki Bukit and Jalan Papan. These locations provide convenient access to major expressways and transport hubs. This strategic placement is intended to attract end-users who prioritize connectivity, efficiency, and proximity to labor forces and supply chains. As a result, these factors enhance leasing attractiveness and potential capital appreciation.

Proven Management Expertise

Mr. Tan Yeow Khoon commenced his entrepreneurial journey in the 1960s and has been instrumental in transforming Singapore into a regional logistics hub. His extensive background as an end-user of industrial properties includes his role as Executive Chairman at Cogent Holdings Limited—a logistics service provider in Singapore formerly listed on SGX Mainboard—which was sold for S$490 million cash to COSCO Shipping International (Singapore) Co., Ltd., leading to its delisting from the exchange.

With an intimate understanding of user needs, management adopts a user-centric development approach characterized by innovative design principles that improve functionality—incorporating features such as wide driveways, ramps, and open or minimally columned spaces across most industrial projects.

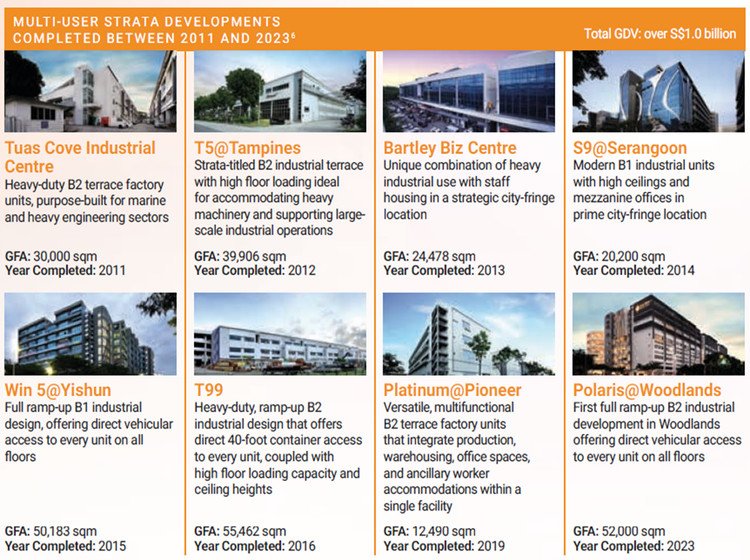

Under Mr. Tan’s guidance, Soon Hock has introduced more than 1,200 units of strata-titled industrial properties through various initiatives across Singapore. Between 2011 and 2019 alone, eight fully sold industrial developments were completed by the group.

Building on strengths in capital investment, construction capability, and effective management controls, Soon Hock aims to position itself as a premier developer within Singapore’s industrial property landscape.

Business Segments: Development & Investment

Soon Hock operates two primary business segments: property development and property investment. The focus lies on multi-user strata industrial developments with an extensive pipeline currently under construction that also allows for reinvestment into new land acquisitions.

Property Development

As of December 31, 2024, development properties under construction totaled S$281.6 million—indicating significant growth from previous years—with these projects expected to contribute positively to near-term profits.

The combined gross development value for four upcoming projects is projected at S$1.0 billion. Notable developments include Stellar@Tampines and Skye@Tuas—both actively under construction—with anticipated completion dates set for Q1 2026 and Q1 2027 respectively; while projects at 20 Shaw Road and Senang Crescent are also well underway with considerable funding secured.

Stellar@Tampines

Situated at Tampines North Drive 4, Stellar at Tampines consists of a modern multi-user ramp-up B2 factory encompassing nine stories (totaling 307 units) along with four units designated for an industrial canteen plus basement parking facilities. The estimated gross development value stands at S$326.5 million.

Positioned within a prime industrial hub designed for sustained demand from both end-users and investors seeking functional spaces with excellent connectivity enhances its marketability significantly.

As part one receives partial Temporary Occupation Permit (TOP) approval on December 11th ,2025 for phase one—which encompasses all structures except the ninth story—the full TOP is expected by March of the following year; enabling revenue recognition from strata title sales starting in late-2025 with projected gross margins around S$81.6 million or approximately twenty-five percent margin overall .

Skye@Tuas

Located in Tuas comprising over three hundred units distributed across three levels including parking areas—the estimated gross developmental value totals approximately S$354 million .

Skye@Tuas targets users requiring large-scale efficient operations near Singapore’s manufacturing corridor benefitting from robust infrastructure support aiding both occupant owners as well investors despite peripheral positioning relative city centers.

20 Shaw Road

A freehold redevelopment initiative located within Tai Seng area—this site promises excellent accessibility due its strategic location amidst established commercial sectors .

Acquired via en bloc transaction worth about118 .8M back April ’25 —with estimates projecting total value upwards235 .4M upon completion slated mid-2026 until late-2028 —the redevelopment process will transform existing structures into modern multi-use facilities catering needs today’s tenants alongside provision dormitories housing900 beds ensuring optimal living conditions workers employed industries therein .

Senang Crescent

This project focuses primarily asset enhancement efforts situated within thriving eastern region benefiting close proximity mature catchments supporting continued relevance among users . Completion target set aligned towards207 expectations generating additional opportunities further down line .

Competitive Landscape

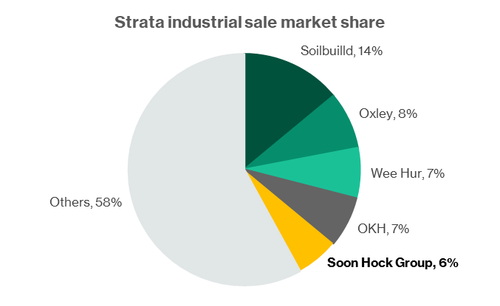

Ranking among top five developers within strata-sale markets boasting roughly six percent market share illustrates strong competitive positioning amid ongoing economic conditions favoring healthy prospects industry-wide looking forward towards sustained growth patterns emerging locally regarding both demand supply dynamics evolving backdrop shaped largely external influences beyond borders impacting interests here closely tied connectively trading partners fueling prospects spurred particularly semiconductor sectors rising substantially linked artificial intelligence advancements seen recently globally transitioning trade relations improving gradually accordingly too .

Looking ahead confidently –positive long-term outlook remains intact given fundamentally sound economic footing underpinning expansion manufacturing sectors observed significantly increasing commitments year-on-year suggesting upward trajectories remain likely pushing boundaries performance metrics achieved thus far continuously evolving standards met satisfactorily addressing expectations laid forth previously seen aligned goals pursued resolutely together collaboratively moving forwards!

By end fourth quarter ‘24 total available floor area registered 471 m square feet encompassing diverse usages principally driven singularly focused approaches creating favorable environments conducive further expansion opportunities arising henceforth encouraging participation growth envisioned consistently maintained throughout lifespan respective ventures undertaken jointly aiming achieve aspirations set forth optimistically always striving betterment collectively transcending limitations faced historically encountered earlier stages progress witnessed along route traveled thus far reached milestones attained commendably throughout entire duration invested endeavorings everywhere ventured upon tirelessly committed towards excellence realized persistently!