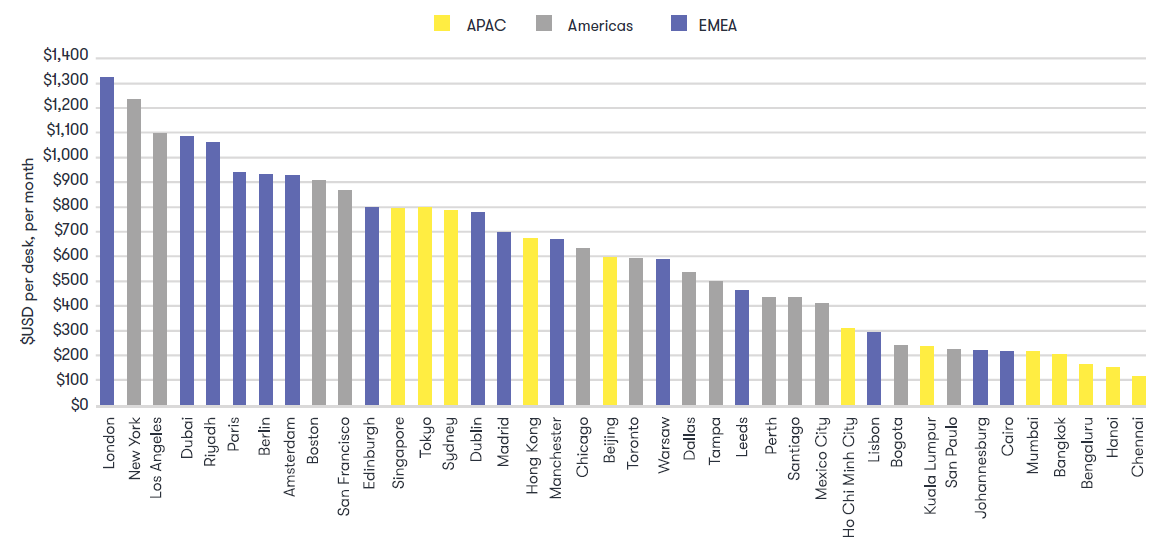

Singapore has solidified its position at the apex of Asia-Pacific’s property market, not through sheer size, but through an uncompromising commitment to quality and strategic importance. Latest reports confirm the city-state is the region’s most premium flexible office market, with prime desks commanding an average monthly rate of around US$800. This top-tier pricing is not an accident; it’s a direct reflection of Singapore’s success as a stable, globally connected regional headquarters hub. For multinational corporations (MNCs) and fast-growing technology scale-ups, the value proposition of a flexible office here extends far beyond a mere physical desk. It’s an instant, high-end presence in one of the world’s most critical financial and commercial ecosystems, allowing them to establish a quick footprint without the considerable capital expenditure and long-term lease commitments of traditional space.

The core driver of this premium pricing is a powerful “flight to quality” trend. Today’s occupiers, particularly MNCs that account for the largest share of the flex market, are not just looking for space—they are seeking an experience. This demand manifests as a fierce competition for centrally located workspaces with state-of-the-art fit-outs, sophisticated technology infrastructure, and premium amenities. Features like collaboration spaces, high-tech meeting rooms, and private phone booths are now seen as essential tools for hybrid work, not mere luxuries. Furthermore, in alignment with global corporate mandates, sustainability credentials carry significant weight in Asia Pacific, pushing operators to invest heavily in green certifications and energy-efficient building designs. Singapore’s limited supply of new, Grade-A office stock in the Central Business District (CBD) only intensifies this battle for prime real estate, allowing landlords and operators to maintain robust rental expectations.

The landscape of flexible work in Singapore is also distinctive due to its attendance patterns. While global flexible workspace occupancy has moderated slightly from post-pandemic highs, data suggests that professionals in the APAC region are spending more time in the office than their counterparts in other parts of the world, averaging over four days a week on-site. This high utilization rate, coupled with the need for immediate, scalable solutions, underpins the willingness to pay a premium. Companies are actively using these high-quality flex spaces as an anchor to entice talent back to the office, viewing the workspace itself as a crucial component of their overall employee value proposition. In this context, the higher desk rate is justified as a strategic investment in talent attraction, retention, and productivity.

While the focus is often on the headline-grabbing flex office market, Singapore’s industrial property sector presents a contrasting yet interconnected picture of the nation’s real estate complexity. Industrial real estate, encompassing factory and warehouse spaces like Gourmet Xchange, operates on an entirely different set of fundamentals driven by manufacturing GDP, logistics demand, and government land policy. Unlike the premium office sector, where rents are driven by corporate status and location prestige, the industrial market is more concerned with efficiency, connectivity to ports and trade routes, and the availability of specialized facilities like high-specification or high-tech spaces. However, the consistent stability and strategic nature of this industrial backbone—supporting the very global businesses that occupy the expensive CBD desks—indirectly contributes to the city-state’s overall investment attractiveness and premium pricing across all asset classes.

Looking ahead, the flexible office market is expected to remain firm. Despite economic uncertainty, the trend towards agility is sticky; companies will continue to opt for flexible solutions to manage headcount and expansion. The sector is moving toward even greater sophistication, with management agreements replacing traditional leases in some cases as a model for growth, allowing operators to scale rapidly while sharing risk with landlords. This evolution underscores a key characteristic of the Singapore market: a dynamic environment where landlords and operators are constantly innovating to meet the exacting standards of the world’s leading firms. The current high price tag, therefore, signals not a temporary bubble, but a deep, structural confidence in Singapore’s enduring role as Asia’s premier business hub.

In essence, Singapore’s status as APAC’s most expensive flex office market is a testament to its highly strategic role. It is a premium paid for a suite of intangible assets: political stability, world-class governance, unrivaled connectivity, and access to a highly skilled talent pool. The high cost per desk reflects the city-state’s commitment to delivering a five-star experience that serves the operational needs of global enterprises, a service that is fundamentally different from the cost-driven considerations governing its industrial or residential sectors. For any business prioritizing speed, quality, and a prestigious regional presence, the current price is simply the necessary tariff for entry into one of the world’s most future-ready commercial landscapes.