Singapore’s property auction market gained fresh momentum in the third quarter of 2025, with listings climbing 10% quarter-on-quarter as buyers and investors returned to the field amid a friendlier interest rate environment. According to Knight Frank, the uptick marks a notable shift in sentiment after several quarters of subdued activity, as both residential and commercial property segments show renewed confidence.

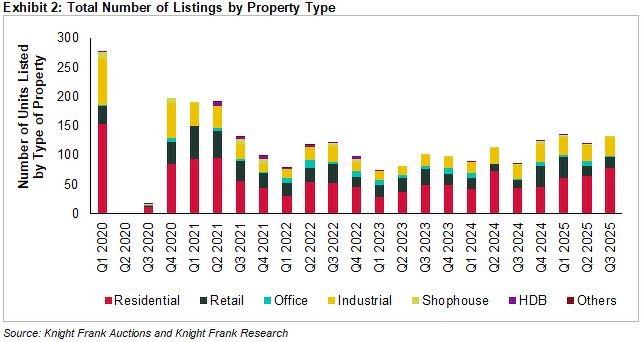

The report noted that a total of 158 properties were placed under the hammer between July and September, up from 143 in the previous quarter. The easing in borrowing costs — following signals of a global rate cut cycle — encouraged more owners and investors to explore auctions as a viable sales route. While overall transaction volumes remain moderate, the momentum points to a stabilizing property market in Singapore, underpinned by resilient demand for quality assets.

Analysts observed that commercial properties, in particular, are drawing increased attention from both local and overseas investors. Many see industrial and retail strata spaces as an opportunity to diversify portfolios in a market where office yields have tightened. Districts such as Tai Seng, Kallang, and Woodlands have seen more activity, especially for industrial and warehouse units that can generate steady rental income.

Knight Frank’s data also showed that mortgagee listings continued to moderate as fewer distressed assets entered the market. Instead, owners are becoming more strategic, using auctions to test pricing and attract competitive bids. This trend reflects a maturing auction landscape in Singapore, where transparency and immediacy are valued amid shifting market conditions.

The report highlighted several notable commercial transactions during the quarter. A freehold light industrial unit at Tagore Lane reportedly fetched strong interest before being sold above its reserve price, reflecting the limited supply of quality assets in city-fringe locations. Meanwhile, a strata retail unit in Katong was sold within minutes of opening bids, underscoring the steady appetite for well-located commercial property with stable foot traffic.

Property consultants said the rebound in auction activity also mirrors broader confidence in Singapore’s economic resilience. As interest rates ease and inflation pressures cool, investors are re-evaluating asset classes that offer a balance between yield and capital preservation. Commercial properties — including shophouses, industrial spaces, and small office units — have become particularly appealing for those seeking inflation-hedged investments.

In addition, institutional investors are quietly returning to the market. Several funds and family offices are scouting for under-valued commercial property, anticipating further upside once the global economy stabilizes. Knight Frank noted that while high-end residential properties continue to attract attention, the industrial and mixed-use segments may deliver more sustainable returns over the next year.

Looking ahead, auction listings are expected to remain elevated into early 2026 as sellers and buyers adjust to new pricing realities. Analysts believe the easing rate environment could fuel another wave of activity, particularly for commercial and industrial assets, as financing costs become more manageable.

Despite lingering global uncertainties, Singapore’s property market remains one of the most stable and transparent in the region. The city-state’s strong fundamentals — robust infrastructure, investor protection, and consistent demand — continue to anchor confidence across segments. If the trend of easing rates persists, the auction market may see more competitive bidding and higher clearance rates in the coming quarters.

For now, the 10% rise in auction listings signals renewed optimism. The combination of easing interest rates and a broader appetite for commercial property suggests that Singapore’s real estate market is entering a more active phase — one defined less by distress and more by opportunity.