The Federal Reserve’s interest rate cuts are bringing hope to the commercial real estate world.

With lower rates, borrowing money becomes easier for investors and developers. This could lead to higher industrial property prices in 2025.

So, the commercial real estate market is expected to see a big boost. Investors and experts are keeping a close eye on these changes. They want to make smart choices.

Understanding Industrial Property Basics

Warehouses, manufacturing facilities, and industrial parks are key to economic growth. They cover a wide range of properties important for industries like logistics, manufacturing, and distribution.

Industrial properties are used for production, storage, and distribution of goods. They include warehouse spaces, manufacturing plants, and industrial parks. Each type has its own role in the economy.

Industrial properties are vital for businesses to operate and grow. Warehouse spaces are essential for logistics and supply chain management. They offer storage solutions for companies.

Industrial parks are centers for manufacturing and distribution. They help boost economic development in their areas.

Knowing about industrial properties is key for investors, businesses, and policymakers. It guides decisions on investments, expansions, and policies affecting the market. The demand for industrial properties changes with e-commerce growth, technology, and global supply chain shifts.

In short, industrial properties like warehouse spaces and industrial parks are crucial for the economy. They support various industries and are important for growth. Understanding these basics helps us see how factors like interest rates affect the market.

The Role of Interest Rates in Real Estate

Understanding how interest rates affect real estate is key for investors and buyers. Interest rates directly impact property values, mainly through the capitalization rate.

When interest rates go up, borrowing costs rise. This can make capitalization rates higher. As a result, property values might drop because investors want more returns to cover the extra costs. On the other hand, falling interest rates make borrowing cheaper. This can lead to lower capitalization rates and higher property values.

Interest rates have a big impact on industrial properties like manufacturing facilities. These properties need a lot of money, and changes in interest rates can change their value a lot. For example, a manufacturing facility’s value might go down if interest rates rise, because borrowing becomes more expensive.

Industrial leasing is also affected by interest rates. As rates change, so does the leasing market. Higher interest rates might make businesses less likely to rent industrial spaces. This is because they have to pay more to borrow money.

In summary, interest rates are very important in the industrial real estate market. Investors and buyers need to think about current interest rates when deciding on manufacturing facilities and leasing. Knowing how interest rates affect property values and borrowing costs helps make better decisions.

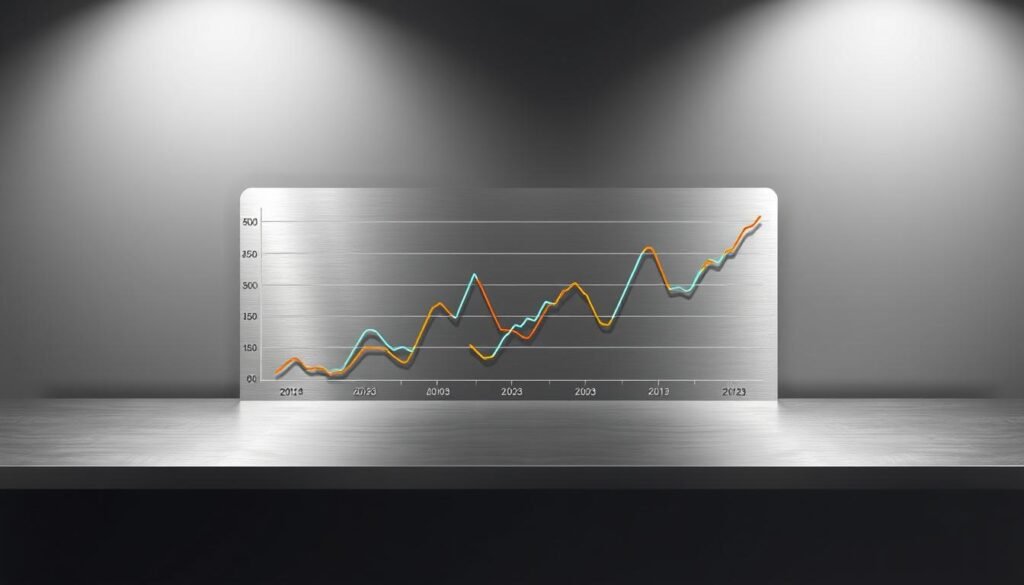

Current State of Interest Rates in 2023

The state of interest rates in 2023 is key for the industrial property market. It’s important for investors, buyers, and sellers to understand these rates. This knowledge helps them make smart decisions.

In 2023, the Federal Reserve has made big moves on interest rates. These changes affect the commercial real estate market a lot. Factors like inflation, job numbers, and global trends play a role in these decisions.

The Federal Reserve’s rate changes have big effects on industrial properties. Higher rates make borrowing more expensive, which can slow down investments. But lower rates make borrowing cheaper, encouraging more investment.

As the market adjusts to these rate changes, it’s vital to keep up with news and trends. Knowing the Federal Reserve’s policies and their economic impact is crucial. This helps everyone in the industrial property market stay ahead.

Predictions for Interest Rates in 2025

Experts say interest rates in 2025 will be shaped by inflation and economic growth. They believe many factors will influence these rates. This includes inflation rates and how fast the economy grows.

The economy is in a tricky spot, balancing growth and inflation. Economists watch GDP, job rates, and inflation closely. They use these to guess where interest rates will go.

Forecasts suggest interest rates might swing in 2025 based on economic shifts. If inflation goes up, rates could rise to fight it. But if growth slows, rates might drop to boost the economy.

These predictions matter a lot for the industrial property market. Changes in interest rates can change borrowing costs for projects. This affects investment choices in the sector.

As the industrial development world keeps changing, knowing about 2025 interest rates is key. Investors, developers, and policymakers need to stay updated. This helps them make better choices about industrial property investments.

Connection Between Interest Rates and Industrial Property Prices

Understanding how interest rates affect industrial property prices is key for smart investment choices in commercial real estate.

Interest rates greatly influence the pricing and demand for industrial properties. Low interest rates make borrowing cheaper. This can boost demand as investors and businesses take advantage of lower costs.

On the other hand, rising interest rates increase borrowing costs. This might lower demand for industrial properties as higher costs deter investors and businesses.

Several case studies show the link between interest rates and industrial property prices. For example, in times of low interest rates, areas with strong industrial growth see big price hikes. This is because more people want to invest.

But, areas with slow industrial growth show less change in property prices. This shows how local economic factors also matter a lot.

Analyzing the Correlation

The link between interest rates and industrial property prices is not simple. Other things like local economy, infrastructure, and technology also matter a lot.

Still, interest rates’ effect on borrowing costs is very important for investors in commercial real estate.

In summary, the relationship between interest rates and industrial property prices is complex. It’s influenced by many factors. Investors need to think carefully about these when making choices in the industrial property market.

Regional Differences in Industrial Property Valuations

Regional differences in industrial property valuations are shaped by many factors, including interest rates. The effect of interest rates on industrial property varies across the United States. Different regions react differently to changes in interest rates.

Several factors contribute to the variation in industrial property valuations across regions. These include local economic conditions, demand for warehouse space, and the area’s infrastructure. For example, areas with high demand for e-commerce logistics, like major ports or transportation hubs, tend to have higher valuations.

A comparison of major US cities shows that cities like New York and Los Angeles are less affected by interest rate changes. This is because they have high demand for industrial space and limited supply. On the other hand, cities with balanced supply and demand for industrial property may see bigger changes in valuations due to interest rate changes.

For instance, cities like Chicago or Dallas might be more sensitive to interest rate changes. This is because they have a larger supply of industrial space. Knowing these regional differences is key for investors and buyers to make smart choices in the industrial property market.

As the industrial property market keeps evolving, it’s vital to watch regional valuation differences. Understanding the factors that influence them is crucial. By keeping an eye on interest rates and their regional effects, investors can stay ahead.

Financing Industrial Property Purchases

Interest rates are key in finding financing for industrial property buys. They change how much it costs and if you can get a loan. This includes properties in industrial parks and for leasing.

Low interest rates make financing cheaper, drawing in investors. But, high rates can scare off buyers because of higher costs.

There are several ways to finance industrial property buys. You can get a bank loan, private financing, or invest through real estate trusts (REITs). The right choice depends on your finances, the property’s location, and current interest rates.

For industrial leasing, there are special financing options. For example, sale-leaseback deals let companies sell their properties and then lease them back. This frees up capital.

Getting financing for industrial properties in parks is also affected by interest rates. Developers and investors must keep up with rate changes to get good deals.

In summary, getting financing for industrial property buys is all about interest rates. Knowing how rates work and their effect on financing is key for buyers, investors, and developers in the industrial real estate world.

The Impact of E-commerce on Industrial Spaces

E-commerce is growing fast, and it’s changing how we use industrial spaces. This change is affecting property prices a lot.

The need for efficient logistics has made warehouse properties very popular. This is because online shopping requires quick delivery of goods.

Because of this, prices for industrial spaces have gone up. This trend is likely to keep going as more e-commerce companies grow.

E-commerce isn’t just changing warehouse needs. It’s also impacting manufacturing facilities. Companies are adjusting to new consumer needs and supply chain demands.

In summary, e-commerce is transforming the industrial property market. It’s affecting both warehouses and manufacturing facilities. Knowing these changes is key for investors and developers in this new world.

The Importance of Location in Industrial Property

Location is key in industrial property. It affects everything from how easy it is to get to, to how much demand there is. Investors and businesses look closely at where a property is when they’re deciding.

Interest rates also shape where people choose to invest in industrial property. When rates are low, people tend to go for places that are growing fast because it’s cheaper to borrow money. But when rates are high, they might pick safer spots with steady demand.

Some areas in the US are major industrial centers. This is because they have great locations, good infrastructure, and easy access to markets. For example, the Inland Empire in California and the Chicago area are top picks for their logistics and transport links.

What makes a location attractive? It’s things like being close to transport hubs, having enough workers, and strong market demand. Good industrial property management means knowing how these things change with the economy, like with interest rates.

In commercial real estate, where a property is matters a lot for its value. Investors and businesses need to think about the location’s current state and future. This helps them make smart choices that boost their investment returns.

Future Trends in Industrial Property Market

Innovations in industrial real estate and changing buyer tastes are reshaping the market. Technology’s growth will bring big changes to how we manage, market, and upkeep properties.

Smart technologies are becoming a big deal in industrial property. IoT, AI, and data analytics are making operations more efficient and cutting costs. For example, smart warehouses with automated systems are gaining traction among e-commerce and logistics firms.

Sustainability is also a major player in the industrial property scene. With more focus on the environment, green buildings and eco-friendly practices are in demand. This trend is boosting interest in energy-saving facilities and renewable energy in industrial spaces.

Buyer behavior is also evolving, affecting the market. The growth of e-commerce has upped the need for logistics and distribution centers. Investors are now looking for properties that meet these needs, like last-mile delivery spots and cold storage areas.

The future of industrial property will mix tech, sustainability, and adaptability. Those who keep up with these trends will likely see big gains in the coming years.

Strategies for Buyers and Investors in 2025

As interest rates change, buyers and investors need smart strategies. Focusing on warehouse space with flexible leasing is key. This lets businesses adjust to new needs.

Industrial leasing is crucial with e-commerce growing. Look for properties with high ceilings, modern features, and good locations near transport hubs.

Staying current with market trends and interest rate forecasts is vital. This helps find great industrial properties at good prices.

Understanding how interest rates affect property prices is crucial. The right strategy, whether in warehouse space or leasing, can lead to success and growth in 2025.