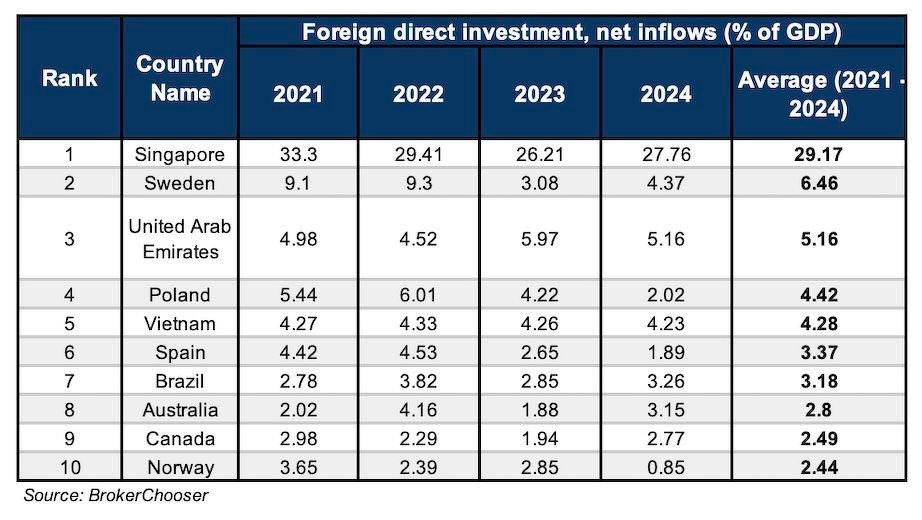

Singapore has once again taken the global spotlight, securing the top spot in BrokerChooser’s 2025 Global FDI Attractiveness Index for the fourth consecutive year. This remarkable achievement not only reaffirms Singapore’s reputation as a trusted global business hub but also highlights its continued ability to attract international capital even amid global economic uncertainties. For investors, especially those with an eye on industrial property, this recognition sends a strong and reassuring signal: Singapore remains one of the most stable and rewarding places in the world to invest.

The reasons behind Singapore’s consistent performance are clear. The nation has built a foundation of political stability, transparency, and pro-business governance that few can match. With its efficient tax system, ease of doing business, and strong protection of intellectual property, Singapore offers an environment where global companies can thrive. These factors have encouraged multinational corporations to base their regional operations here, creating ripple effects across multiple sectors—including industrial real estate, which continues to see strong demand for high-quality, well-located spaces.

Over the past few years, industrial property in Singapore has evolved from being a niche investment category into a key pillar of the economy. The rise of e-commerce, logistics, and food manufacturing has driven demand for modern facilities equipped with advanced infrastructure and smart technology. Properties such as The AC Food Building, Tampines Connection, and Space 18 are good examples of how Singapore is redefining industrial spaces. These developments combine innovation, efficiency, and sustainability, providing the perfect environment for businesses that value operational excellence and long-term growth.

Foreign direct investment plays a central role in shaping this demand. Every time a company channels funds into Singapore—whether to set up a manufacturing plant, expand a distribution network, or develop a food processing facility—it creates lasting demand for industrial spaces. This close relationship between FDI inflows and real estate needs makes the industrial sector one of the most resilient and promising segments in the market. For investors, this translates into steady rental income, low vacancy rates, and a solid foundation for capital appreciation over time.

Another reason industrial property remains attractive is Singapore’s forward-looking development strategy. The JTC Corporation and private developers continue to transform traditional industrial estates into modern business ecosystems that support innovation and sustainability. By integrating green building standards, digital capabilities, and flexible layouts, these projects ensure that Singapore’s industrial sector remains relevant and competitive. This forward momentum enhances the long-term value of industrial assets, making them a strategic addition to any investment portfolio.

Singapore’s position as a top FDI destination also reflects global confidence in its economic vision. As companies around the world look for reliable hubs to manage operations in Asia, Singapore’s strategic location and world-class infrastructure give it a significant edge. The ongoing diversification of global supply chains—accelerated by geopolitical shifts and evolving trade routes—has further increased Singapore’s importance as a logistics and manufacturing hub. These trends directly benefit industrial property investors, who can expect continued demand from tenants across technology, logistics, and food production sectors.

What makes Singapore especially compelling for investors is the stability it offers. Industrial assets in the city-state have proven to deliver consistent yields even during economic fluctuations. The combination of high occupancy rates, government-backed industrial development, and a mature leasing market creates a dependable investment environment. As sustainability and automation continue to shape the future of industry, Singapore’s industrial real estate market is well-positioned to evolve alongside global demand.

For investors seeking long-term security and meaningful growth, this is a market worth paying attention to. Singapore’s leadership in FDI rankings shows not only that the country remains a preferred global destination for capital but also that its economic fundamentals are strong and future-ready. Industrial property, in particular, stands out as a sector that will continue to benefit from these trends, offering investors a stable and scalable opportunity in a market known for its resilience and innovation.

Singapore’s continued success at the top of the global FDI charts is more than just a point of pride—it’s a clear indicator of the country’s ability to adapt, attract, and sustain growth in an ever-changing world. For those ready to invest, the industrial property sector offers a chance to be part of this growth story, supported by a nation that has proven time and again that it knows how to build for the future.